|

The

flexibility of

money, as with so many of its qualities, is most clearly and

emphatically expressed in the stock exchange, in which the money

economy is crystallized as an independent structure just as political

organisation is crystallized in the state. The fluctuations on exchange

prices frequently indicate subjective-psychological motivations, which,

in their crudeness and independent movements, are totally out of

proportion in relation to objective factors.

Georg Simmel. The Philosophy of Money.

1900/1979.

|

Introduction

Why use

sonification?

The ASX

All-Ordinaries Index (XAO)

Net Returns

Sonification of Net

Returns

Uniform Random

(white–noise)Returns

Gaussian (bell-shaped) Returns

Decorrelation of Returns

Summary Snapshots

Introduction

There are many reasons, both

sociological and

technical, why capital

markets are an interesting application–domain for sonification.

Sociologically, they have become a

powerful, some might say almost religious, contemporary force, even as

their overtly emotional expressive open-outcry marketplaces have

become, or are quickly becoming, virtualised gatherings of disembodied

screen traders. Sonification of the activities of these markets thus

functions as a form of re-embodiment.

While such sociological

considerations are interesting, the studies reported here are more

pragmatic and

descriptive. Despite intensive study, a comprehensive

understanding of the

structure of capital markets exchange trading data remains elusive. For

an overview of this issue, see Chapter 5 of Sonification

and

Information, including more

detail of the techniques illustrated here, or just read a brief overview of market data.

Why use sonification?

The power of visual representation to enhance and deepen the

understanding of phenomena and their abstractions is undisputed. Yet,

as with many time-domain processes, visual representation does not

always reveal the structure of the data. In The (mis)Behavour of the Markets

Benoit Mandelbrot emphasises the difficulty, even impossibility, of

distinguishing the difference between real market data and

computer-generated Brownian motion using graphs.

This leads to a sonification question: Are there ways of

presenting trading data that enable its structural characteristics to

be perceived aurally?

To explore that question, we sonify the XAO, an

Australian

market index, along with a computer-generated statistical analogue

of it for comparison.

The ASX All-Ordinaries Index (XAO)

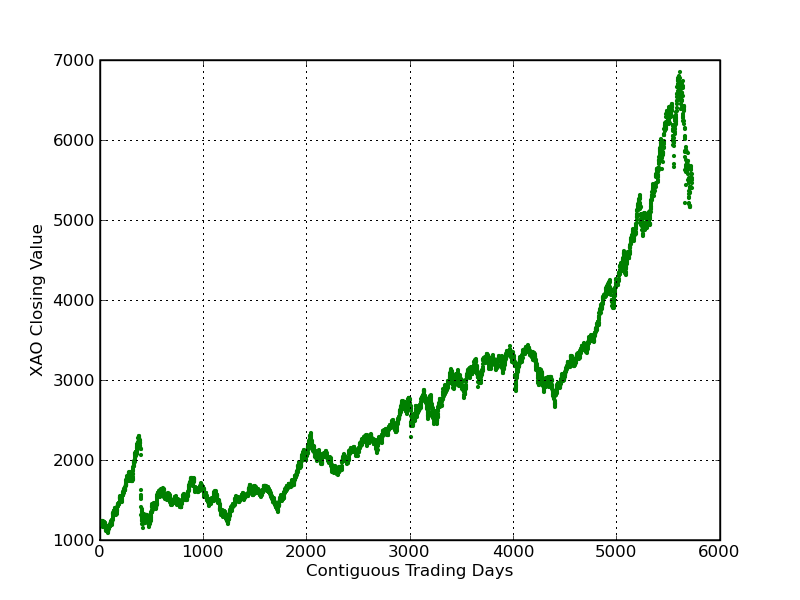

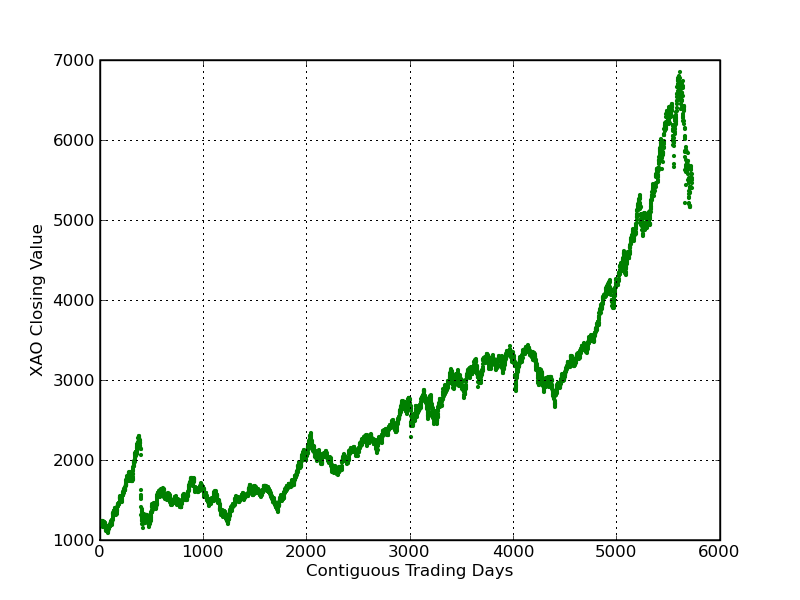

The dataset chosen is twenty-two years (21April 1986 to 18 April 2008)

of the daily closing price of All Ordinaries Index (ticker XAO) of the

Australian Securities Exchange (ASX). The XAO is the broad Australian

market indicator, a composite of the 500 largest companies,

weighted by

capitalisation, which are listed on the exchange. Figure 1 is a

graphical representation of this datset.

Figure 1. 22

years of daily closing prices

of the ASX-XAO. Figure 1. 22

years of daily closing prices

of the ASX-XAO.

Net Returns

As

the value of XAO increase roughly exponentially over time, the

technique chosen here is to convert the dataset in to a series of

net-returns, or ratios of successive value differences. For an asset

whose price changed from p(t) at time t to p(t+dt) at time t+dt, the

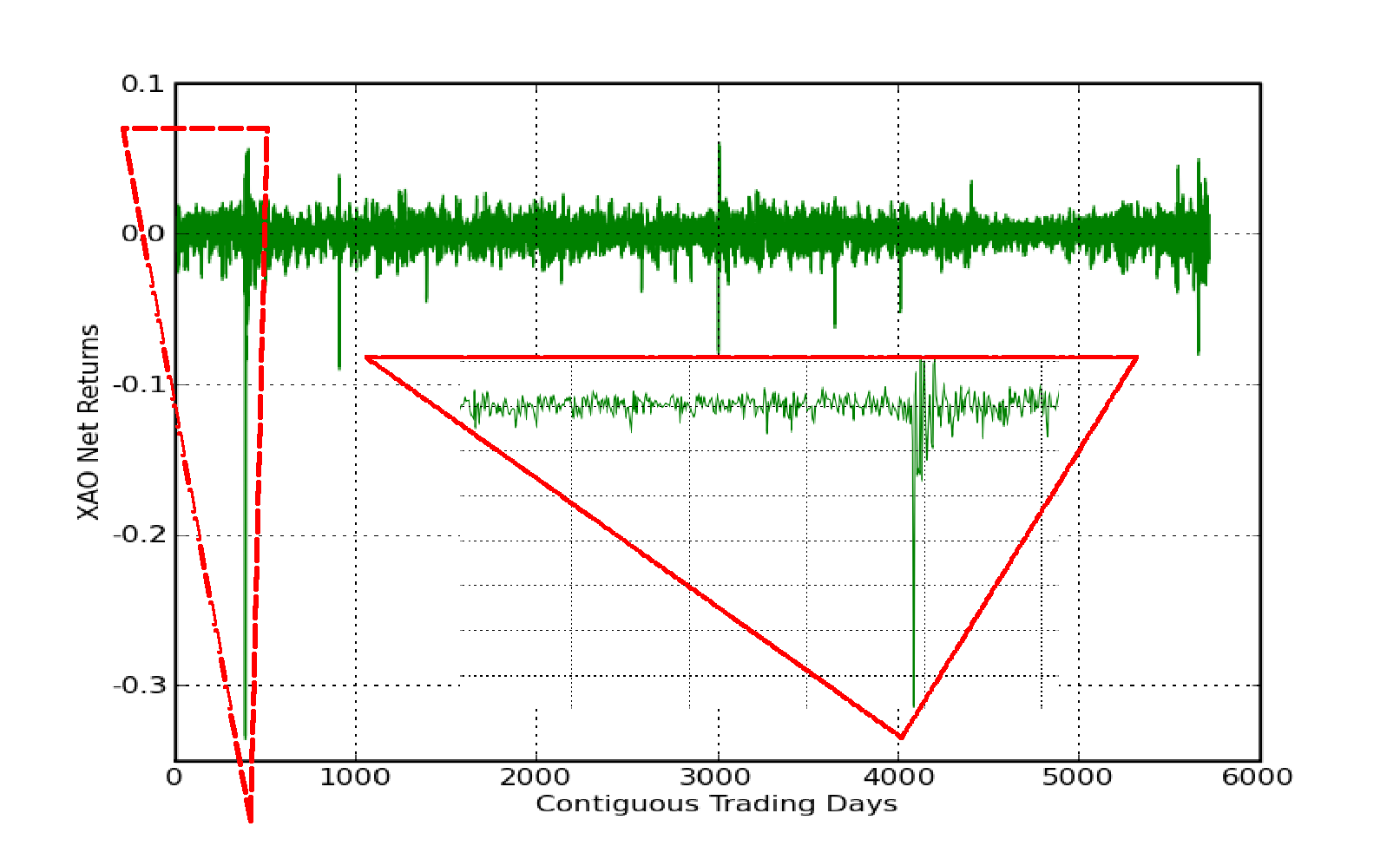

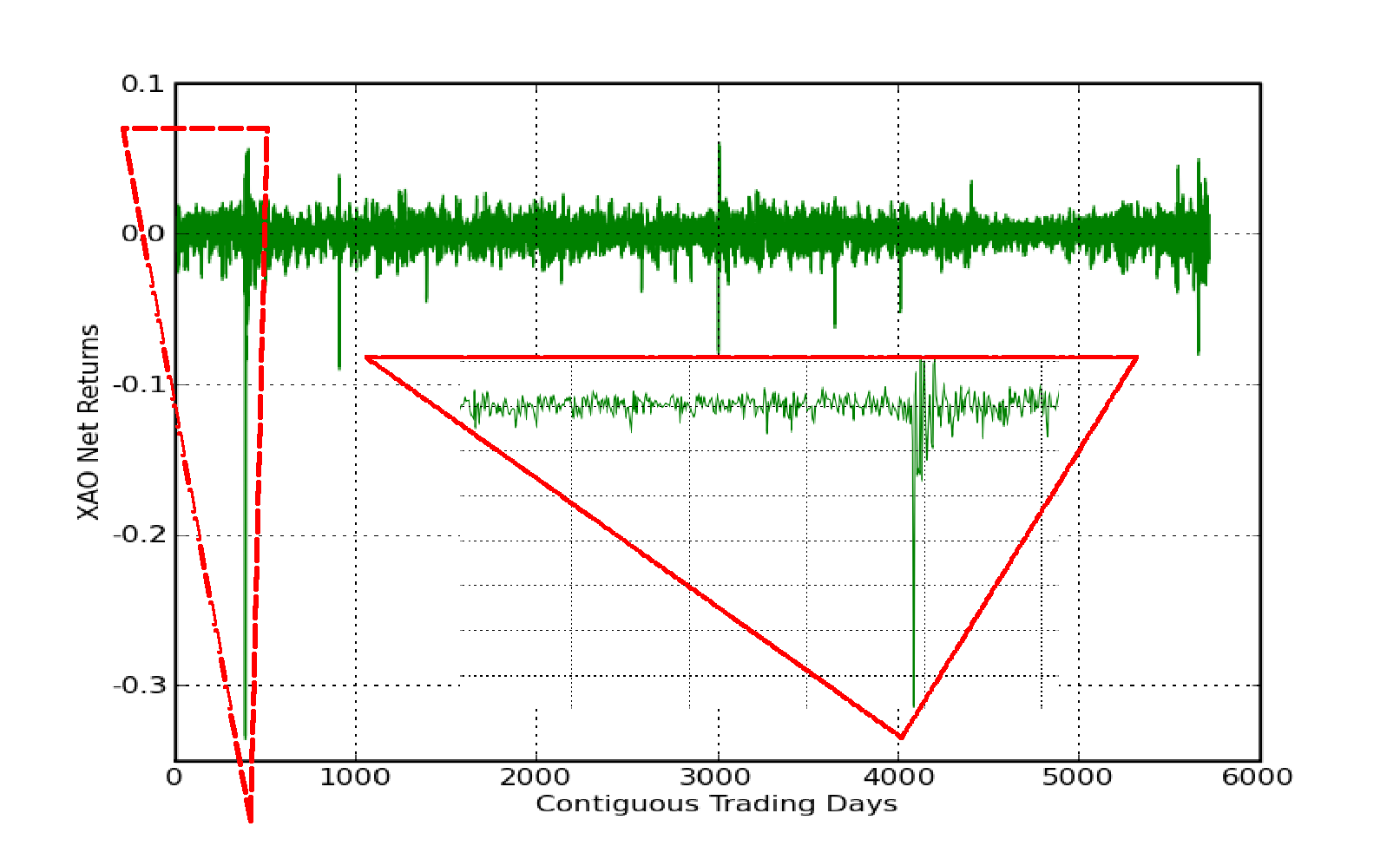

linear net returns Rnet are defined as (p(t+dt) - p(t))/p(t). Figure 2

is a graphical representation of these net returns. The insert is an

amplification of the dotted sesction containing a very negative

return–that of 20 October 1987 (“Black Tuesday"), the largest one-day

percentage decline in stock market history.

Figure 2. Graph of the Net Returns of the

XAO dataset.

Sonification of Net Returns

Clearly,

there are a number of possible mappings of his dataset into sound.

Because it basically oscillates around zero, it is possible to audify

it directly. However, for this discussion we map it using a very simple

technique we call homomorphic

mapping sonification in which the zero is assigned a centre frequency

and the positive and negative returns are used to modulate that

frequency within a fixed range. (For an exposition of using direct

audification, see Chapter 5 of Sonification

and

Information.)

In the following

audio example, the

modulation rate is 8 Hz (i.e. 8 tones per second), the centre frequency

is 300Hz and the frequency range is three octaves. The "Black Tuesday"

return has been reduced to the next lowest level (near the left-hand

corner of the insert triange) in order to more effctively use the pitch

range.

play XAO net returns

sonification (7.6 Mb MP3 file)

Larger changes in pitch indicate larger changes, i.e. higher volatility, in $value.

NB: If you don't want to download the whole file and that of the other

3 examples, you can download a single file of 20

second snippets of all 4 examples (1.4Mb MP3 file - see the Summary at the bottom of this

page). This is the third

snippet.

How can the sonification of net-returns

be characterised? One way is to compare it those of other known

datasets. This leads to a second sonification question:

Can

real trading data

be distinguished

from a stochastic simulation of it?

Notice the overwhelming

preponderance of small pitch changes (small changes in net returns)

with occasional periods of greater volatility. This is even clearer

when we compare it to a couple of standard distributions: uniform random, and Gaussian.

Uniform Random (white–noise) Returns

In a uniform

random, or "white noise" distribution, all net returns all are equally

likely. Here is a sonification of uniformly random net returns to

compare with the market net returns:

Gaussian/Normal (Bell-Shaped) Returns

In a Gaussian,

"normal" or bell-shaped random distribution, the net returns with the

greatest frequency are centred round the mean and those furthest away

from the mean occur less often. In this manner, normally-distributed

returns are more statistically similar to market returns than uniformly

random returns. In fact classical quantitative theory (after Bachelier)

proposes that they are identical. Here is a

sonification of a set of normally distributed random returns, with the

same mean and standard deviation as the original set of market returns.

Decorrelation of Returns

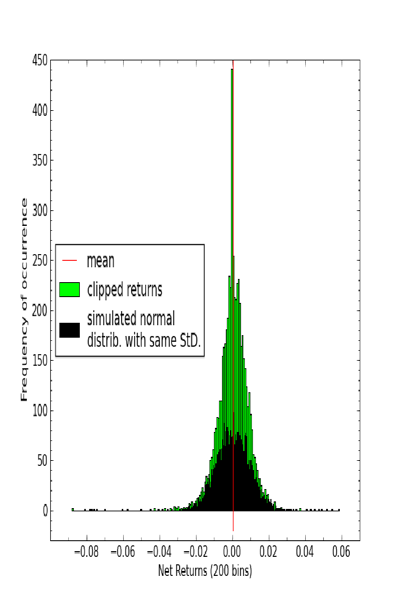

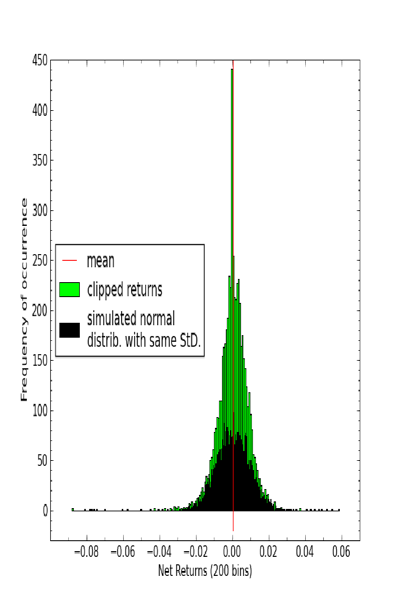

Figure

3 is an overlay of histograms of a normal distribution with that of the

returns dataset. It clearly illustrates that the returns

are not normally distributed: more returns are bunched around the mean

and in the tails of the market net returns distribution than in a

normal distribution.

As a final comparison, a sonification of a statistically identical but

decorrelated dataset to the net returns is presented. While they both

appear to have short trending auto-correlative sequences, those

of the net returns appear more consistently and when they do they

appear to last for longer periods of time.

play

decorrelated net returns

sonification (7.6 Mb MP3 file)

|

Figure 3. A overlay

of a histogram of the clipped net returns (green), with a histogram of

a simulated normal

distribution with the same mean, standard deviation and number of datum

(black).

|

Summary Snapshots

As a summary, here is 4 snippets of

sonifications of the four datasets presented in this overview.

A. Uniformly distributed random data.

B. Normally distributed random data.

C. XAO Net Returns data.

D. Decorrelated XAO Net Returns data.

|

market

sonifications

market

sonifications Figure 1. 22

years of daily closing prices

of the ASX-XAO.

Figure 1. 22

years of daily closing prices

of the ASX-XAO.