market

sonifications

market

sonifications

using the sonipy framework

| sonification HOME | Some examples of using

sonification to explore trading–data 2. Intraday $value sonification |

|||||||||||

| closing price

sonification intraday sonification CONTACT links |

|

Introduction

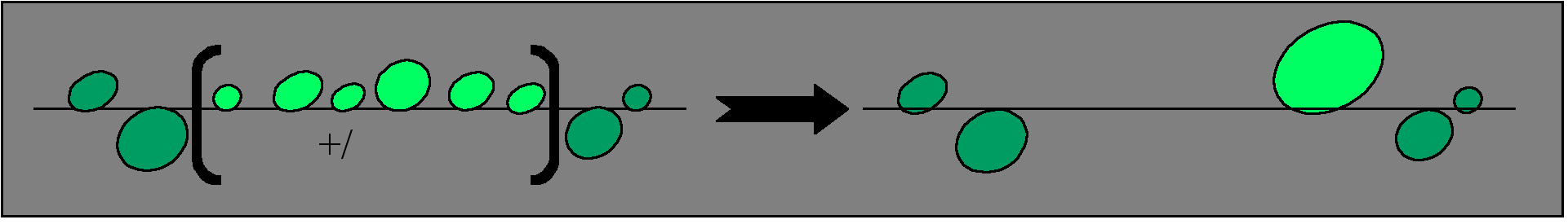

A statistical

analysis of the datset described above reveals that in each security

there is a preponderance of small-$valued trades (in the $3000-5000K

range), including many at the same price. For the purposes of this

sonification, all all trades

that occurred sequentially at the same price were accumulated into a single

sonification event. This process is illustrated graphically in Figure 1.

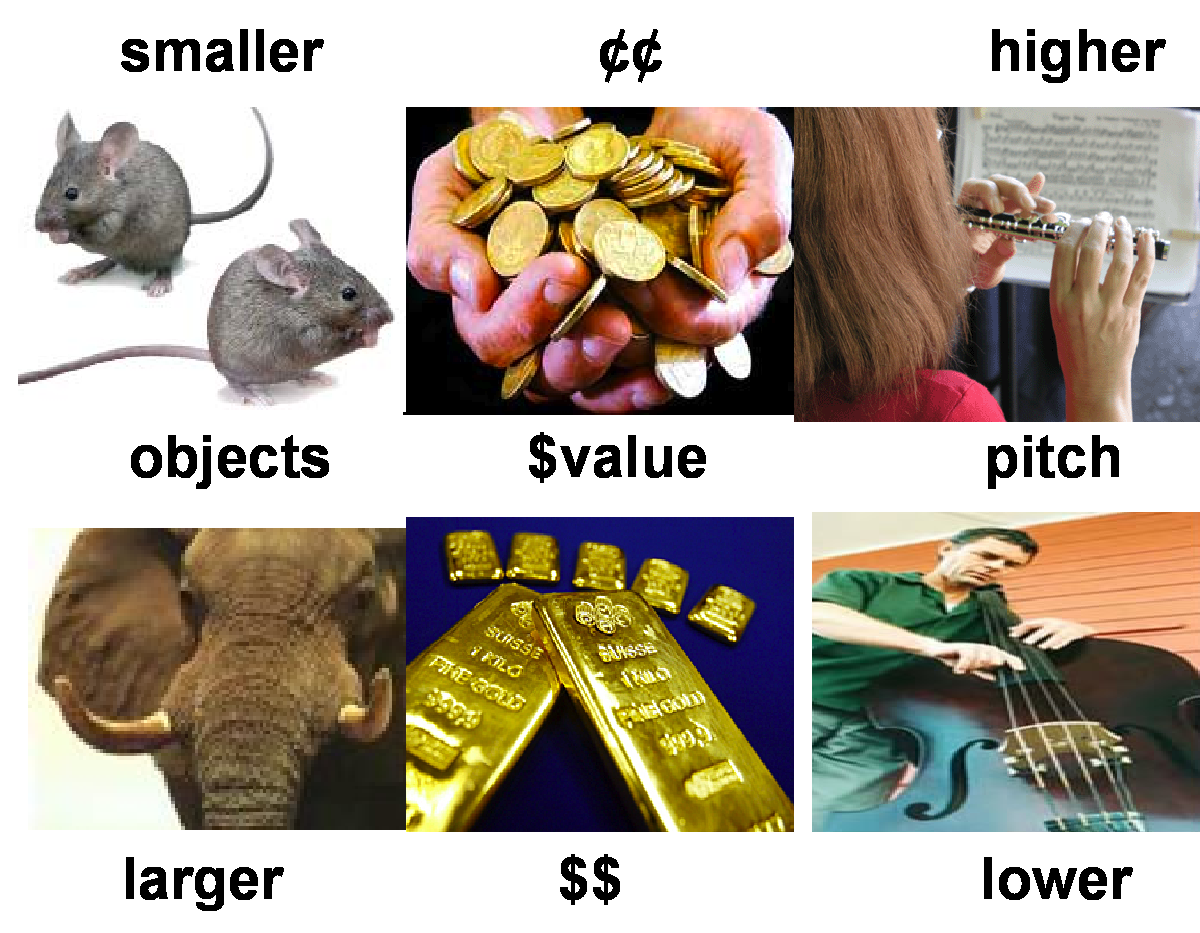

Perceptually, the

size of an object is habitually related to its mass, as evidenced by

the surprise when picking up a large piece of pumice. Portentous

objects and events in the natural world are more usually associated

with lower-pitched, less frequent sounds. For example, there appears to

be many more small birds than large ones, and so on. A basic

statistical analysis of the TRADE data reveals proportionally fewer

high-$value trades than low-$value trades, indicating that $value is in

line with these principles outlined, as symbolically illustrated in

Figure 2.

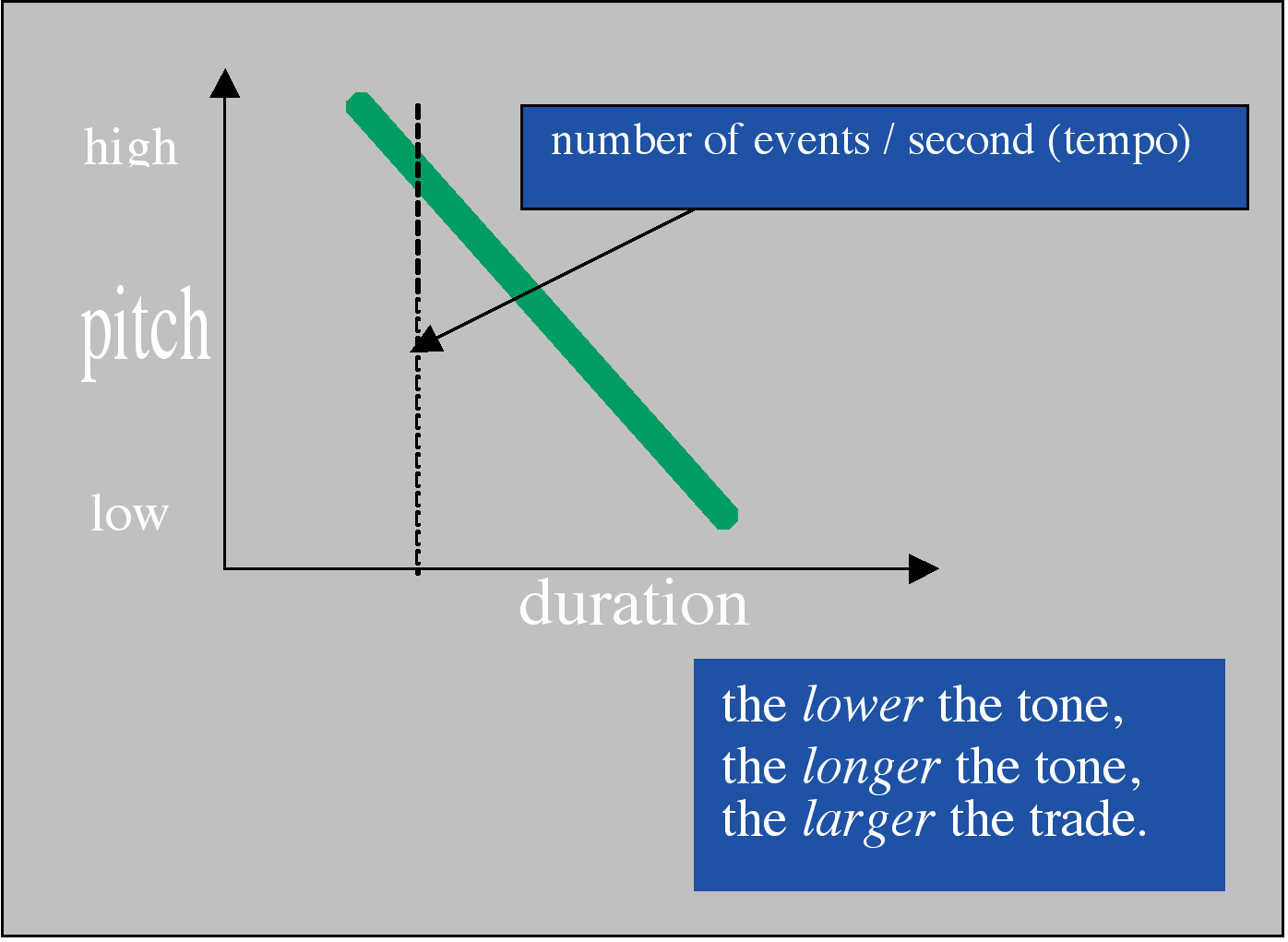

Similarly,

there appears to be an inverse relationship between the duration of an

event type and its frequency (of occurrence). When compared to smaller

events, larger events in the same domain occur less often and last for

a longer period of time than smaller ones: the snap of a twig is more

frequent and shorter than the crash of a tree, the scurry of mice more

frequent than a stampede of elephants etc. So, when sonifying larger

$valued trades at lower frequencies, it is necessary to increase their

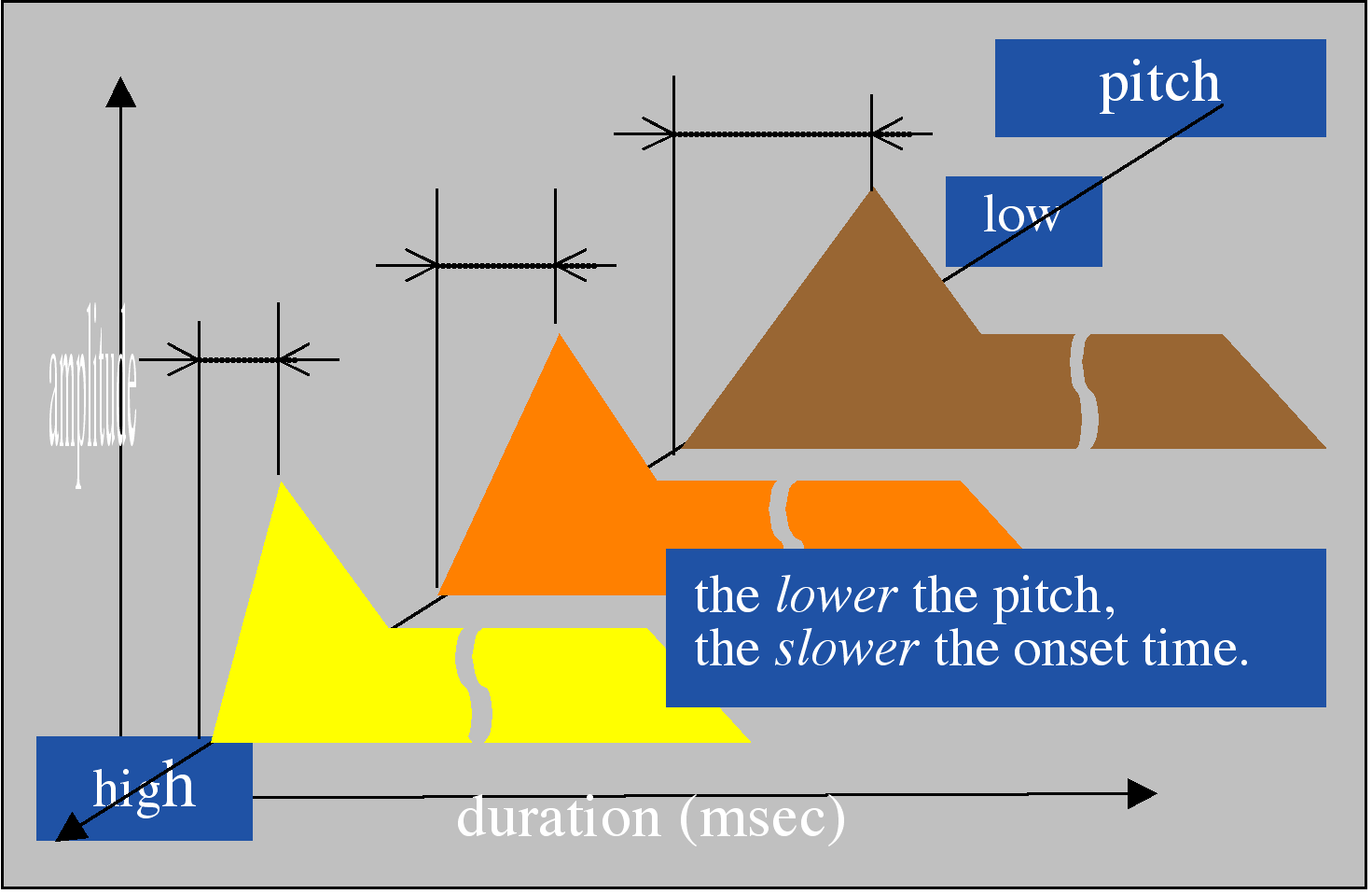

relative duration, comparatively. So, for the reasons just outlined, in this experiment, a proportional inverse mapping was applied between sound frequency and the $value of each trade accumulation. The psychoacoustic mapping as are illustrated in Figure 3 between pitch and duration, and in Figure 4, between a tone’s onset–time and pitch.

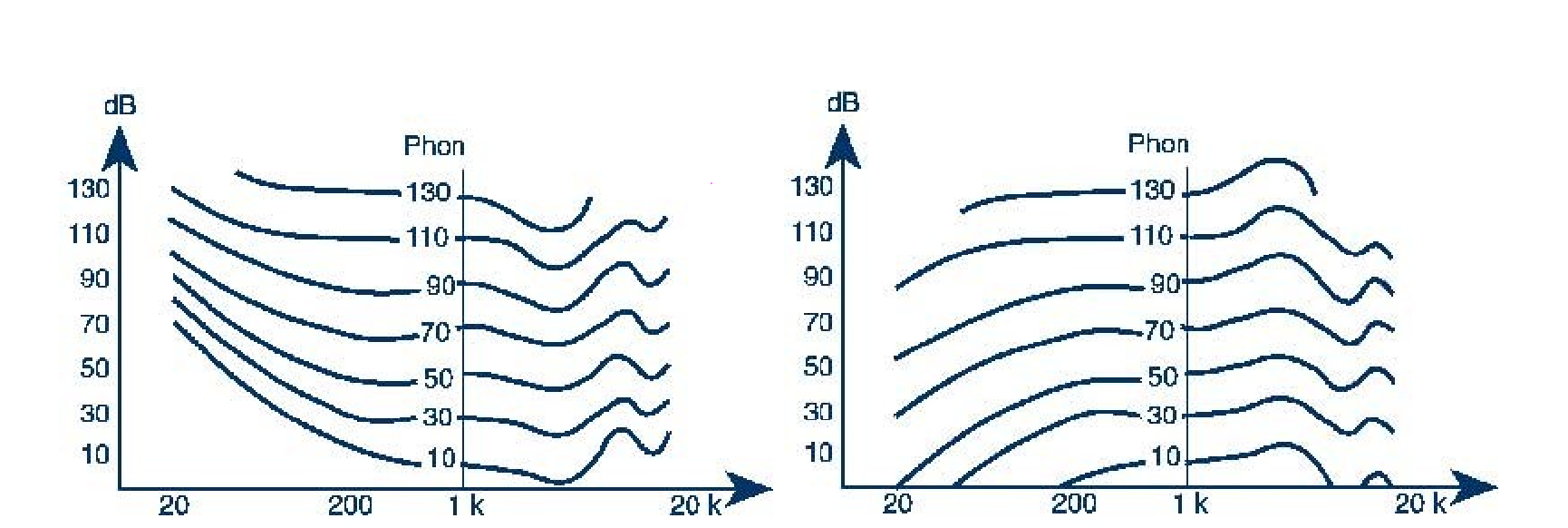

A further

psychoacoustic adjustment was made using a very basic ‘inverse

Fletcher–Munson curve of equal loudness‘, as illustrated in Figure 5. This adjustment is applied to

counter–balance the known psychoacoustic phenomena that the centre of

the pitch gamut of human hearing is more amplitude–sensitive than at

the extremes.

The sound rendering instrument The csound instrument used to render this new dataset to sound was designed for straightforward fine adjustment of the acoustic–psychoacoustic relationships: the emphasis being on clarity of articulation rather than complexity of timbre. Some examples Here is a sonification of a full day's trading using the above mapping. Time has been compressed 60 times, so on minute of trading is represented by one second of audio. play full Day

accumulations (5.6 Mb MP3 file)

Time ratio: 1:60 Clearly,

small trades dominate the market Here is athere is a preponderance of

smaller $value trades. Here is a sonification of 30 minutes of market

time in which all trade accumulations less that $50,000 have been

filtered out.

play 30 minutes of trades > $50K (528K MP3 file) Time ratio: 1:60 Because of the accumulation technique employed, the five Market On Open events (the incremental opening of the market in groups) are not well pronounced. The middle of the day clearly has less activity – lunchtime perhaps – and the increased activity and volatility towards the end of the trading day is quite noticeable, especially in the last fifteen or twenty minutes of trading. Also clear, is the Market On Close event, on the day presented in this example, there is only one. In the second example, there is still a relative preponderance of smaller–$value trades, but that is to be expected. The volatility of the market can be easily inferred from this mapping. Adding a second mapping Here is another experiment with the cumulative mapping technique employed above. A sonification event only occurs when the price changes so, to each event a second pitch is appended to indicate whether the TRADE that triggered the sonification event was a decrease or increase movement in price. The pitch of that tone is higher when the price increased and lower when it decreased; the size of the interval between the two tones indicating the extent of the price difference. Notice this use of a rise in pitch to represent a rise in $value is the opposite of that used to represent $value itself, where a lower pitch represents a higher $value. Here is the technique applied to the middle of the day: play 60 minutes middle-of-day with price direction (896K MP3 file) >$50K. ratio: 1:60 play 60 minutes end-of-day with price direction (1Mb MP3 file) >$50K. ratio: 1:60 There appears to be no difficulty in cognitively separating the two opposing mapping paradigms when they are superimposed. None appeared to have any difficulty in separating the two paradigms. In fact, without being informed of the opposition, most listeners tested were not aware of the conflict in the first place! This informal experiment illustrates that it is possible for superimposed concepts to be easily separated cognitively even when mapping of the two paradigms into the same psychoacoustic space is opposed: intention, that is information, can take precedence over perception and sensation when given the conditions to do so.

|

||||||||||